Subscribe To My Newsletter

Discover the top stocks impacted by Trump’s proposed tariffs and why they present unique buying opportunities this Thanksgiving week.

Estimated Reading Time: 6 minutes

Category: Stocks Recommendations

Reader Level: Beginner to Intermediate Investors

Introduction

Thanksgiving week often serves as a crucial moment for savvy investors, offering opportunities amidst market volatility. This year, the stakes are even higher following President-elect Donald Trump’s announcement of proposed tariffs targeting international trade. These policies have rippled across the stock market, particularly affecting tech-heavy sectors reliant on global supply chains.

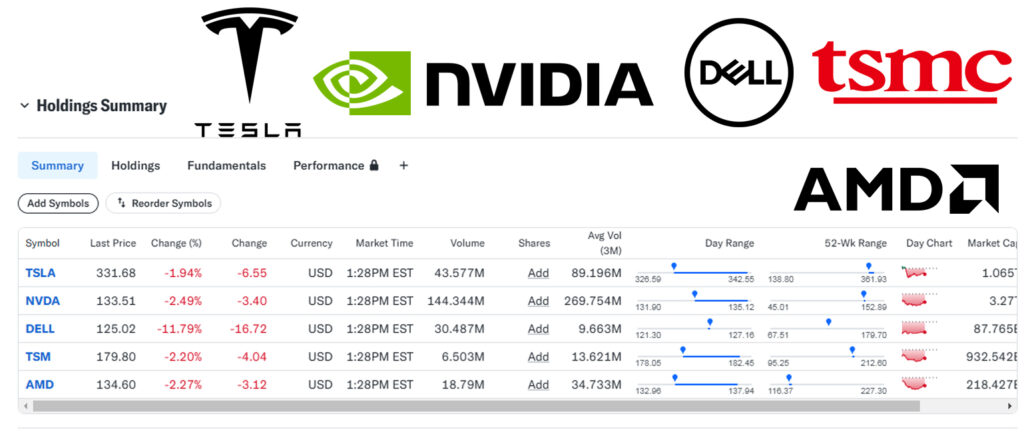

Notable high-performing stocks such as Tesla (TSLA), NVIDIA (NVDA), Dell Technologies (DELL), Taiwan Semiconductor Manufacturing Company (TSM), and Advanced Micro Devices (AMD) have seen price dips. As of November 27, 2024, these stocks hit significant lows, creating a potential window for strategic investments. Below, we analyze these stocks and their growth potential amid these developments.

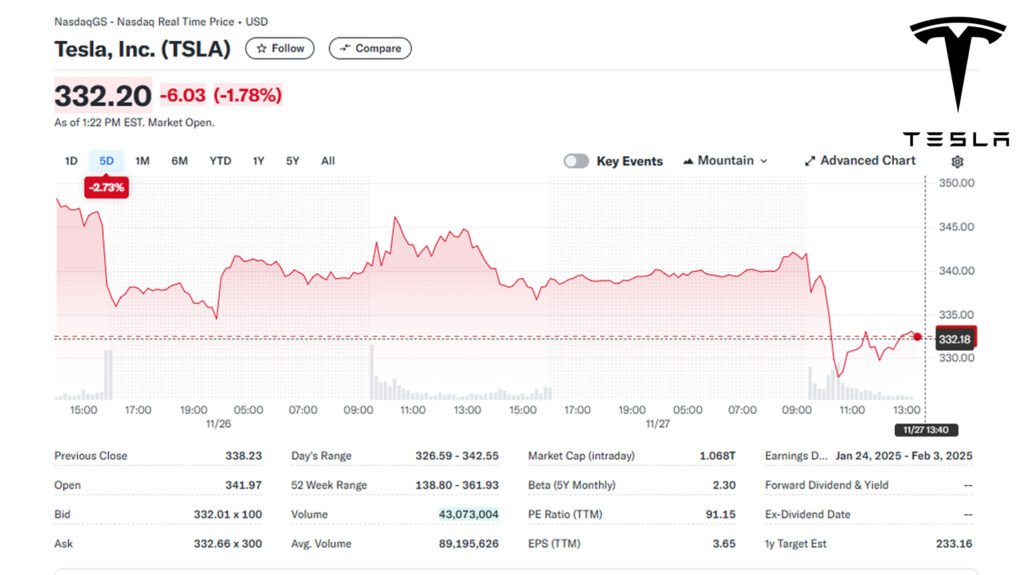

1. Tesla (TSLA)

- Open (Nov. 27, 2024): $341.80

- High (Nov. 27, 2024): $342.55

- Low (Nov. 27, 2024): $326.59

Tesla’s Thanksgiving week dip presents an enticing opportunity for investors. As a global leader in electric vehicles (EVs) and renewable energy, Tesla continues to thrive despite market turbulence. The tariff-related dip is likely temporary, given Tesla’s expansion into markets like India and Southeast Asia and its robust innovation pipeline.

Growth Potential:

Tesla’s revenue growth remains strong, supported by increasing demand for EVs and its growing energy storage business. Analysts project its year-end delivery numbers to exceed expectations, further boosting its stock value.

Key Factors to Consider:

- Record-breaking Q3 vehicle deliveries.

- Expansion into energy storage solutions (e.g., Powerwall and Megapack).

- Potential headwinds from supply chain risks and global political uncertainty.

Verdict: TSLA’s price drop is a golden opportunity for long-term investors betting on the EV revolution.

2. NVIDIA Corp (NVDA)

- Open (Nov. 27, 2024): $135.01

- High (Nov. 27, 2024): $137.22

- Low (Nov. 27, 2024): $131.80

NVIDIA’s decline this Thanksgiving week reflects concerns over potential supply chain disruptions due to tariffs. However, its dominance in AI computing, gaming GPUs, and data centers ensures its long-term prospects remain intact.

Growth Potential:

The surge in demand for AI technologies and partnerships with cloud computing giants like AWS and Microsoft keep NVIDIA ahead of its competitors.

Key Factors:

- Leadership in AI and gaming GPUs.

- Strong collaborations with cloud computing providers.

- Risks include consumer market slowdowns and tariff implications.

Verdict: NVIDIA remains a top choice for tech investors. The current dip is a rare opportunity for those focused on long-term gains.

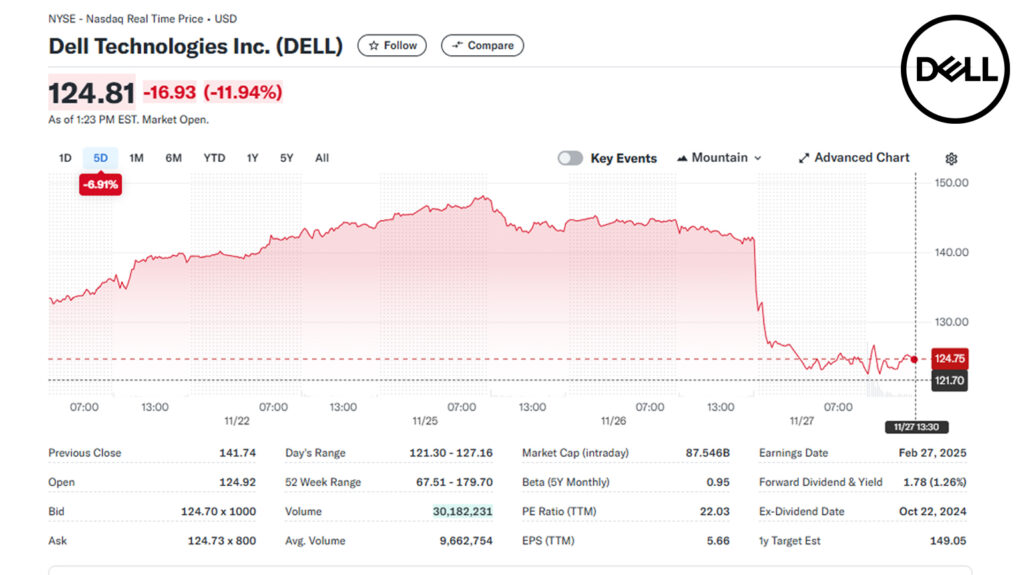

3. Dell Technologies Inc (DELL)

- Open (Nov. 27, 2024): $124.92

- High (Nov. 27, 2024): $127.16

- Low (Nov. 27, 2024): $121.30

Dell, known for its enterprise tech solutions, has taken a hit amid market volatility. However, its investments in AI and data storage position it as a critical player in the tech landscape.

Growth Potential:

Dell’s growth is fueled by strong Q3 earnings and increased corporate spending on tech infrastructure.

Key Factors:

- AI-driven hardware integration for enterprises.

- Robust corporate IT spending driving revenue.

- Risks include competition from startups and economic uncertainties.

Verdict: DELL’s price drop offers a solid entry point for value-oriented investors looking for stable tech growth.

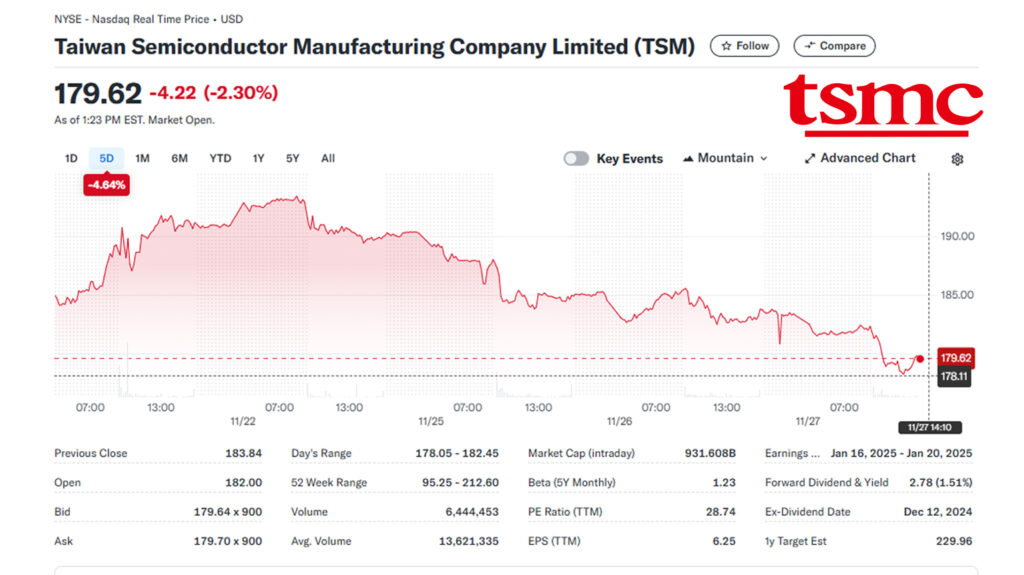

4. Taiwan Semiconductor Mfg. (TSM)

- Open (Nov. 27, 2024): $182.00

- High (Nov. 27, 2024): $182.45

- Low (Nov. 27, 2024): $178.05

As the world’s leading semiconductor manufacturer, TSM plays a crucial role in the global tech ecosystem. Its dip this week stems from concerns over tariffs targeting Taiwanese imports, but its position remains unshaken.

Growth Potential:

TSM is expanding its manufacturing presence in the U.S. and continues to lead in chip production for AI, 5G, and IoT applications.

Key Factors:

- New manufacturing facilities in Arizona to counter tariff risks.

- Critical supplier to major players like Apple, NVIDIA, and AMD.

- Risks include geopolitical tensions and reliance on global supply chains.

Verdict: TSM’s strategic importance and market dominance make it an excellent long-term investment.

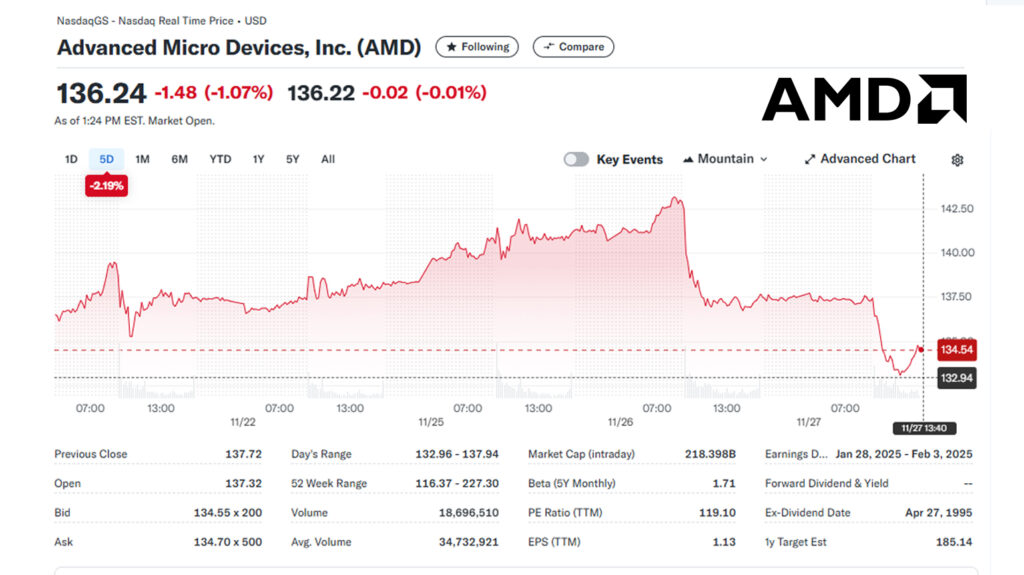

5. Advanced Micro Devices, Inc. (AMD)

- Open (Nov. 27, 2024): $137.20

- High (Nov. 27, 2024): $137.94

- Low (Nov. 27, 2024): $132.96

AMD has emerged as a strong competitor in the semiconductor space, challenging both Intel and NVIDIA. Its recent dip offers a compelling entry point for investors seeking exposure to high-performance computing and AI.

Growth Potential:

AMD’s diversified portfolio, including consumer GPUs and enterprise processors, ensures its relevance in a rapidly evolving tech industry.

Key Factors:

- Recent acquisitions like Xilinx driving innovation.

- Competitive edge in AI and gaming processors.

- Risks include pricing pressures and reliance on TSM for chip production.

Verdict: AMD’s current valuation presents a balanced risk-reward profile, ideal for growth-focused investors.

Conclusion

Thanksgiving week offers a unique chance for investors to capitalize on market volatility caused by tariff-related concerns. Stocks like TSLA, NVDA, DELL, TSM, and AMD showcase strong fundamentals and long-term growth potential. While these dips might represent temporary opportunities, investors should also consider the possibility of new price ranges for these stocks.

As always, conduct thorough research and align investments with your risk tolerance and financial goals. This period could be a chance to close out 2024 with strategic portfolio gains.

Follow

Frequently Asked Questions (FAQs)

- What caused the dips in these stocks during Thanksgiving week?

Proposed tariffs by President-elect Trump raised concerns about supply chain disruptions and rising costs, affecting tech-heavy sectors. - Are these stocks likely to recover?

Long-term prospects for these stocks remain strong due to their market dominance and innovation, but short-term volatility may persist. - Is this the right time to invest?

If you have a long-term outlook and can tolerate short-term risks, these dips may represent buying opportunities. - Should I buy now or wait for further price adjustments?

While current prices may seem attractive, investors should conduct thorough research and assess their risk tolerance before buying. - How can I monitor these stocks?

Use platforms like Google Finance, and Yahoo Finance, or set up alerts for real-time updates.

Stay Connected!

If you found this information helpful, don’t forget to like, comment, and share! Stay connected by visiting my website and following me on social media @benlopezra for the latest insights, updates, and stock recommendations. Together, we can navigate the markets with confidence!

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research or consult with a financial professional before making investment decisions.

Originally published at https://benlopezra.com on November 27, 2024.